As an e-commerce business, most of the data you need to report in your tax returns likely comes from your main sales channel software, such as Amazon, Stripe, or Shopify. We have direct integrations with these platforms, allowing us to automatically extract your data each month and include it in your tax returns.

For any additional transactions, you can populate the Excel template with the relevant data for inclusion in your tax returns.

TABLE OF CONTENTS

Downloading the template file

If you need to include additional data in your tax returns, download the template and populate it with your transaction details.

To download the template:

- Log in to CrossTax (our VAT reporting product).

- Navigate to the Data Upload section.

- Download the template File on the right.

Populating the template file

The Excel template file contains four sheets:

- Instructions: A guide on how to complete the template.

- Sample data: a view on what a populated template might look like.

- Your Data: Where you’ll input your transaction data.

- ISO Codes: A reference to the ISO codes to be used for each country and currency

Below is an overview of the fields in the template and how to populate them:

| Field | Is it mandatory? | What to include |

| Transaction type | Yes | Define the type of transaction (e.g., sale, refund). |

| Subject of the transaction | Yes | Indicate whether the transaction is for Goods, Services, or Electronically Supplied Services (ESS). ESS applies to SaaS businesses, app downloads, etc. |

| Sales channel | No | Only relevant for sales and refunds. Specify if the sale was made directly to a consumer or through a marketplace. |

| VAT number | No | Do not include your own VAT number here. For sales, include your customer's VAT number (if available). For purchases, include your supplier's VAT number (if available). |

| Transaction date | Yes | The date the transaction occurred (dd-mm-yyyy format). |

| Invoice number | Yes | A unique reference number for the transaction |

| Departure country | Yes | For sales, enter the country the sale was made from. For refunds of goods, enter the original ship-to country. Use 2-digit ISO codes (e.g., GB, US, FR). |

| Customer's country | Yes | For goods, enter the shipping country. For services, enter the customer’s location. Use 2-digit ISO codes. |

| Currency | Yes | The currency of the transaction (e.g., EUR, GBP, USD). |

| Gross amount | Yes | The total transaction amount, including taxes. Refunds or credit notes should be entered as negatives. |

| VAT reporting country | No | Enter the country where the transaction should be reported. If unknown, our system will determine it. |

| VAT rate | No | Enter the VAT rate as a % per the invoice, e.g. 20%. If not known, our system will estimate it based on the information provided. However, we cannot guarantee the accuracy without the information. |

| Net amount | No | Enter the value of the transaction, excluding taxes. Refunds or credit notes should be entered with a negative sign. If not known, our system will determine it based on the information provided. |

| VAT amount | No | Enter the VAT (or GST) charged on the invoice. Refunds or credit notes should be entered with a negative sign. If not known, our system will determine it based on the information provided. |

Specific cases

Below we have set out how to populate the file for specific cases to ensure accurate reporting.

Amazon invoices

Amazon issues invoices for advertising, marketing etc with local VAT charged. An example invoice is provided here along with how to report it in the template file.

| You can complete the template as follows: Transaction type = Purchase Subject of the transaction = Service Sales channel = n/a VAT number = GB172046918 (enter Amazon's VAT number here) Transaction date = 30-09-2022 Invoice number = GB-AOUK-2022-829 Departure country = GB Customer's country = GB (enter the country where the VAT is charged) Currency = GBP Gross amount = 7315.70 VAT reporting country = GB VAT rate = 20% Net amount = 6096.42 VAT amount = 1219.28 |

Reclaiming import VAT

When you import goods into the EU, it is possible to reclaim the import VAT paid at the time of entry of the products into the EU (please consult with import regulations in the country of entry).

Here is how to complete the template file for import transactions:

Transaction type = Purchase

Subject of the transaction = Goods

Sales channel = n/a

VAT number = n/a

Transaction date = the date when import VAT was paid formatted DD-MM-YYYY

Invoice number = reference number of the import document (this is for your record-keeping)

Departure country = ISO code of the country of departure of your products, such as CN for China or US for the United States

Customer's country = the country where you paid import VAT (for example DE if your products entered through Germany)

Currency = the currency in the import documents (EUR, for example)

Gross amount = The total amount of the invoice, including VAT paid.

VAT reporting country = the country where you paid import VAT

VAT rate = VAT rate on your invoice (may be left blank if you are unsure)

Net amount = the amount of the transaction, tax excluded (may be left blank if you are unsure)

VAT amount = the amount of import VAT paid to be reclaimed (may be left blank if you are unsure)

Declaring deferred import VAT

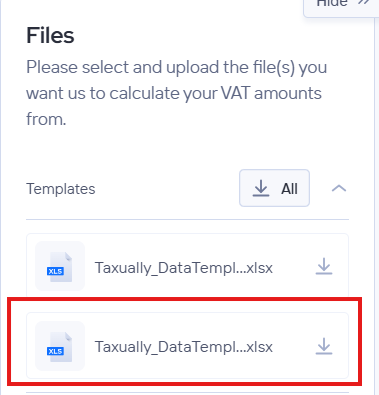

Make use of the second template file (see below).

Follow the same steps mentioned above for a standard import.

In column P, select 'yes' for Deferred Import, and the relevant rules will be applied.

Uploading the template file

Once you have completed the template, you can upload it into CrossTax. If there is no data already loaded for the month, you can upload it by clicking on "Data upload" in the left hand navigation menu and then select the relevant month from the drop down box

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article